Summary of Significant Sccounting Policies

Critical Accounting Policies and Key Sources of Estimates

The application of the International Financial Reporting Standards requires the use of estimates and assumptions that affect the amounts of assets and liabilities reported at the date of financial statements and the amounts of income and expenses during the reporting period. The management of the Corporation will necessarily make judgments and estimates that could have a significant effect on the amounts presented in the financial statements according to IFRS. Likewise, changes in assumptions and estimates could have a significant impact on the financial statements in conformity with such standards. A summary of the key estimates and judgments used is as follows:

a) Useful Economic Lives of Property, Plant and Equipment – The useful lives of the assets of property, plant and equipment that are used for calculating the depreciation are determined based on technical studies prepared by specialists (both internal and external). When there are indicators that could lead to changes in the estimated useful lives of such assets, these changes shall be performed by using technical estimates. The studies shall consider the specific factors related to the use of the assets.

b) Ore Reserves – The measurements of ore reserves are based on estimates of the ore resources that are economically exploitable, and reflect the technical considerations of the Corporation regarding the amount of resources that could be exploited and sold at prices exceeding the total cost associated with the extraction and processing. The Corporation applies judgment in determining the ore reserves, and as such, possible changes in these estimates could significantly impact the estimates of net revenues over time. For such reason, these changes would lead modifications in the usage estimates of certain assets and of the amount of certain decommissioning and restoration costs.

These estimates of reserves are based on methods and standards customary in the mining industry, which are supported by the historical experience and the assumptions of the Corporation regarding the production costs and the market prices.

The Corporation periodically reviews such estimates, supported by world class external experts, who certify the determined reserves.

c) Impairment of Assets – The Corporation reviews the carrying amount of its assets to determine whether there is any indication that those assets have suffered an impairment loss. If any such indication exists, the recoverable amount of the assets is estimated in order to determine the extent of the impairment loss in regard to the carrying amount. In the evaluation of the impairment, the assets are grouped in cash generating units (“CGU’s”) to which the assets belong. The recoverable amount of these assets or CGU’s is calculated as the present value of the cash flows expected to be derived from such assets, considering a pre-tax discount rate that reflects current market assessments of the time value of money and risks specific to the asset. If the recoverable amount of the assets is less than their carrying amount, an impairment loss exists.

The Corporation defines the CGUs and also estimates the timing and cash flows that such CGUs should generate. Subsequent changes in the grouping of the CGU, or changes in the assumptions supporting the estimates of the cash flows or the discount rate, could impact the carrying amounts of the corresponding assets.

The Corporation has assessed and defined that the CGUs are constituted at the level of each of its current operating divisions.

The review for impairment includes the subsidiaries and associates.

d) Provisions for Decommissioning and Site Restoration Costs – An obligation to incur in decommissioning and site restoration costs when environmental disturbance is caused by the development or ongoing production of a mining property. Costs are estimated on the basis of a formal closure plan.

The costs arising from the installation of a plant or other site preparation works discounted at their net present value are provided for and capitalized at the beginning of each project, as soon as the obligation to incur such costs arises. These decommissioning costs are charged to net income over the life of the mine, through depreciation of the asset. The depreciation is included in the operational costs, while the unwinding of the discount in the provision is included as finance costs The costs for restoration of site damages, which are created on an ongoing basis during production, are provided for at their net current values and charged to profit or loss for the year as extraction progresses.

Decommissioning, site restoration and environmental provisions are provided for at the present value at the date such obligations are known, considering a pre-tax discount rate that reflects current market assessments of the time value of money and risks specific to the related liabilities. The environmental costs are estimated by using also the work of external specialists and/or internal experts. The Corporation’s management applies its judgment and experience to provide for and amortize these estimated costs over the useful life of the mine.

e) Provision for Employee Benefits – Employee benefits cost for severance payments and health benefits for services rendered by the employees, are determined based on actuarial calculations by using the Projected Credit Unit Method, and are charged to profit or loss on an accrual basis.

The Corporation uses assumptions to determine the best estimate of these benefits. Such estimates, as well as the assumptions, are determined together with an external actuary. These assumptions include demographic assumptions, the discount rate and expected salary increases and the rotation levels, among others. Although the Corporation believes that the assumptions used are appropriate, a change in these assumptions could affect profit or loss.

f) Provisions for Open Invoices – The Corporation uses information on future copper prices, through which it performs adjustments to its revenues and trade receivables, due to the conditions of its provisional invoicing. These adjustments are updated on a monthly basis.

g) Fair Value of the Derivatives and Other Instruments – Management uses its criterion to elect an adequate and proper valuation method for the instruments that are not quoted in an active market. The Corporation applies customary valuation techniques used by other professionals in the industry. In the case of the derivative financial instruments, the assumptions are based on the quoted market rates, adjusted in conformity with the specific features of the instruments.

h) Lawsuits and Contingencies –The Corporation assesses on an ongoing basis the probabilities of lawsuits and contingencies losses according to estimations performed by its legal counselors. In case management and its legal counselors believe that a favorable outcome will be obtained or when the results are uncertain and the lawsuits are still pending of resolution, no provisions are recognized.

Principal Accounting Policies

a) Period Covered – The accompanying consolidated financial statements of Corporación Nacional del Cobre de Chile include:

- Statements of Financial Position as of December 31, 2010, December 31, 2009 and January 1st, 2009.

- Statements of Comprehensive Income for the periods ended on December 31, 2010 and 2009, respectively.

- Statements of Changes in Equity for the periods ended December 31, 2010 and 2009, respectively.

- Statements of Cash Flows for the periods ended December 31, 2010 and 2009, respectively.

b) Basis of Preparation – The consolidated financial statements of the Corporation as December 31, 2010 have been prepared in conformity with IFRS, as issued by the IASB.

The statements of financial position as of December 31, 2009 and January 1, 2009 and the statements of comprehensive income, of net equity and of cash flows for the period ended December 31, 2009, included for comparative purposes, have been prepared in conformity with IFRS, on a consistent basis with the criteria used by the Company for the same period ended on December 31, 2010.

These consolidated financial statements have been prepared based on the accounting records kept by the Corporation.

c) Responsibility for the Information and Use of Estimates – The Board of Directors of the Corporation has been informed regarding the information included in these financial statements and expressly states its responsibility for the consistent and reliable nature of the information incorporated in the consolidated financial statements as of December 31, 2010, for whose effects have been applied in full the IFRS principles and criteria as issued by the International Accounting Standards Board. These financial statements were approved by the Board of Directors at its meeting held on March 23, 2011.

d) Functional Currency – The functional currency of Codelco is the US dollar, which is the currency of the primary economic environment in which the Corporation operates and the currency in which it receives its revenues.

Transactions other than those in the Corporation’s functional currency are translated at the exchange rate prevailing at the date of the transactions.

Monetary assets and liabilities denominated in currencies other than the functional currency are retranslated at closing exchange rates. Gains and losses from on translation are included in profit or loss within the line item “Exchange rate differences”.

The presentation currency of the consolidated financial statements of Codelco is the US dollar.

The functional currency of the subsidiaries, associates and jointly controlled entities, which is the same as Codelco, corresponds to the currency of the primary economic environment in which those entities operate and the currency in which they receive their revenues, as established in IAS 21. However, regarding those subsidiaries and associates that correspond only to an extension of the operations of Codelco (entities that are not self-sufficient and whose main transactions are performed with Codelco), the functional currency corresponds to the US dollar as this is the currency of Codelco.

When the indicators are mixed and the functional currency is not obvious, management uses its judgment to determine the functional currency that most faithfully represents the economic effects of the underlying transactions, events and conditions under which each entity operates.

e) Basis of Consolidation – The consolidated financial statements incorporates the financial statements of the Corporation and its subsidiaries.

In the consolidation process all significant balances and transactions between the consolidated companies have been fully eliminated, and the participation of the non-controlling interest has been recognized and presented as “Noncontrolling Interest”. The consolidated financial statements take into account the elimination of intercompany balances, transactions and unrealized profit and loss between the consolidated companies, including foreign and local subsidiaries. The Companies incorporated in the consolidation are as follows:

For the purposes of these financial statements, subsidiaries, associates, acquisitions and disposals and jointly controlled entities are defined as follows:

- Subsidiaries: A subsidiary is an entity over which the Corporation has power to govern its operating and financial policies in order to obtain benefits from its activities. The consolidated financial statements include all assets, liabilities, revenues, expenses and cash flows of Codelco and its subsidiaries, after eliminating all inter-company balances and transactions. For partly owned subsidiaries, the net assets and the net earnings attributable to the minority shareholders are presented as “Non-controlling interests” in the consolidated statements of financial position and consolidated statement of income.

Likewise, on consolidation, the Corporation incorporates those entities where does not hold any direct or indirect ownership interest but represent a special purpose entity, in accordance with the criteria established in SIC Interpretation 12, Consolidation – Special Purpose Entities. - Associates: An associate is an entity over which Codelco is in the position to exercise significant influence, but not control or jointly control, through the power to participate in the financial and operating policy decisions of that entity.

Codelco’s share of the net assets of such entities is included in the consolidated financial statements by using the equity method. This requires recording the initial investment at cost and then, in subsequent periods, adjusting the carrying amount of the investment to reflect the Codelco’s share in the results of the associates, less any impairment of goodwill and any other changes in the associate’s net assets. - Acquisitions and Disposals: The results of businesses acquired are incorporated in the consolidated financial statements from acquisition date; the results of businesses sold during the period are incorporated in the consolidated financial statements up to the effective date of disposal. Gains or losses from the disposal are calculated as the difference between the sale proceeds (net of expenses) and the net assets attributable to the ownership interest which has been sold.

- Jointly Controlled Entities: The entities that qualify as jointly controlled entities, in which there exists joint control over the operating and financial decisions, are accounted for by using the equity method.

- Special Purpose Entities (SPE’s): The substance of the relationship between Codelco and Fundación de Salud El Teniente (FUSAT), indicated that such entity is controlled by Codelco. As such, the consolidated financial statements of FUSAT are incorporated to the consolidation of Codelco. The consolidated financial statements of the FUSAT include the following entities:

f) Foreign Currency Transactions – Monetary assets and liabilities denominated in foreign currency have been translated into U.S. dollars at the closing exchange rate of the period.

At the reporting period-end, monetary assets and liabilities denominated in currency other than the functional currency, indexed in unidades de fomento (UF or inflation index-linked units of account) (12/31/2010: Ch$21,455.55; 12/31/2009: Ch$20,942.88; 1/1/2009: Ch$21,452.57), are translated into U.S. dollars at the closing exchange rates.

Income and expenses denominated in Chilean pesos have been translated into U.S. dollars at the exchange rate at the date when the transaction was recorded in the accounting records.

Exchange differences are recognized in net income in accordance with IFRS. The financial statements of the subsidiaries, associates and jointly controlled entities, whose functional currency is different from the presentation currency of Codelco, are translated using the following procedures:

- Assets and liabilities for each statement of financial position presented shall be translated at the closing rate at the date of that statement of financial position.

- Income and expenses for each statement of comprehensive income or separate income statement presented shall be translated at average exchange rates of the reporting period.

All resulting exchange differences are recognized as a separate component of net equity.

The exchange rates used in each period are as follows:

g) Offsetting Balances and Transactions – As a general standard, assets and liabilities, income and expenses, are not offset in the financial statements, except for those cases in which offsetting is required or is allowed by some standard and the presentation is a reflection of the transaction.

Income or expenses arising from transactions, which, for contractual or legal reasons, consider the possibility of offsetting and which the Corporation intends to liquidate for their net value or realize the assets and pay the liabilities simultaneously, are stated net in the statement of income.

h) Property, Plant and Equipment and Depreciation – The items of property, plant and equipment are initially recognized at cost. After their initial recognition, they are recorded at cost, less any accumulated depreciation and any accumulated impairment losses.

The costs of the items of property, plant and equipment related to the extension, modernization or improvement representing an increase of the productivity, capacity or efficiency or an increase of the useful life of the assets is capitalized as cost of the corresponding assets.

Furthermore, the investments in assets acquired under the method of lease contracts with purchase options that meet the characteristics of a financial lease are included in this item. These items are not legally owned by the Corporation until the corresponding purchase option is exercised.

The items included in property, plant and equipment are depreciated in accordance with the straight-line method over their economic useful life, which are summarized in the following table:

The assets maintained under financial lease are depreciated during the estimated period of the lease contract or in accordance with the useful life of the assets, whichever is lower.

The estimated useful lives, the residual values and the depreciation method are reviewed at each year end, recording prospectively the effect of any change in estimates.

The profit or loss from the disposal or withdrawal of an asset is calculated as the difference between the price obtained in the disposal and the value recorded in the ledgers recognizing the charge or credit to net income for the year.

Work in progress includes the amounts invested in the construction of assets of property, plant and equipment and in mining development projects. Work in progress is transferred to assets in operation once the testing period has terminated and when they are available for their use, and start to be depreciated as of such moment.

The ore deposits owned by the Corporation are recorded in the accounting records at US$1 (one US dollar) and the economic value of these deposits differs from the accounting value.

Certain items of property, plant and equipment were, at the transition date to IFRS, recorded at fair value and this fair value was used as their deemed cost, in conformity with the optional exemption established in IFRS 1, First Time Adoption of International Financial Reporting Standards (IFRS 1).

Borrowing costs that are directly attributable to the acquisition or construction of assets that require a substantial period of time before they are ready for their use or sale will be considered as part of the cost of items of property, plant and equipment.

i) Impairment of Property, Plant and Equipment and Intangible Assets – The items of property, plant and equipment and the intangible assets of definite useful life are reviewed for impairment, in order to verify whether there is any indication that the carrying value cannot be recovered. If such an indicator exists, the recoverable amount of the assets is estimated to determine the extent of the impairment loss. Where the asset does not generate cash flows independently from other assets, Codelco estimates the recoverable amount of the cashgenerating unit (CGU) to which the asset belongs.

For such purposes, each division of the Corporation has been defined as a cash generating unit.

The measurement of impairment includes the subsidiaries and associates. The recoverable amount of an asset will be the higher of the fair value less costs to sell the asset and its value in use. When evaluating the value in use, the estimated future cash flows are discounted using an interest rate, before taxes, that shows the market evaluations corresponding to the time value of money and the specific risks of the asset, for which the future cash flow estimates have not been adjusted.

If the recoverable value of an asset or cash generating unit is estimated to be less than its carrying amount, an impairment loss is immediately recognized reducing the carrying amount up to its recoverable amount with charge to net income. In case of a subsequent reversal of the impairment, the carrying amount increases to the reviewed estimate of the recoverable amount, but only to the point that it does not exceed the carrying amount that would have been determined, if no impairment would had been recognized previously. A reversal is recognized as a decrease in the charge for depreciation for the year.

For cash generating units (CGU’s), the future cash flow estimates are based on the estimates of future production levels, future prices of the basic products and the future production costs. IAS 36 “Impairment of Assets†includes a series of restrictions to the future cash flows that can be recognized regarding the restructurings and future improvements related to expenses. When calculating the value in use, it is also necessary to base the calculations on the current exchange rates at the moment of the measurement.

j) Exploration, Mine Development and Mining Operations Costs and Expenses – The Corporation has defined an accounting criterion for each of these costs and expenses.

Development expenses of deposits in exploitation whose purpose is to maintain the production levels are charged to net income when incurred.

Exploration and drillings of deposits, expenses include the expenses destined to locate mineralized areas to determine their possible commercial exploitation and are charged to net income when incurred.

Pre-operating and mine development expenses (PP&E) incurred during the execution of a project and until its start up are capitalized and amortized in relation to the future production of the mine. These costs include extraction of waste material, constructing the mine’s infrastructure and other works carried out prior to the production phase.

Finally, the costs for the delimitation of new areas or deposit areas in exploitation and of mining operations (PP&E), are recorded in property, plant and equipment and are charged to income during the period in which the benefits are obtained.

k) Income Taxes and Deferred Taxes – Codelco and its Chilean subsidiaries record Income Tax based on the net taxable income determined as per the standards established in the Income Tax Law and Article 2 of the D.L. 2,398, as well as the specific tax to the mining activity referred to in Law 20,026 of 2005. Its foreign subsidiaries record it according to the tax standards of each country.

The deferred taxes generated by temporary differences and other events giving rise to differences between the accounting and tax base of assets and liabilities are recorded according to IAS 12 “Income Taxesâ€.

In addition, a deferred tax is recognized for the net income of subsidiaries, associates and special purpose entities, originated by the withholding taxes on remittances of dividends paid by such companies to the Corporation.

l) Inventories – Inventories are stated at cost, which does not exceed their net realizable value. The net realizable value represents the estimated sales price less all finishing costs and the marketing, sales and distribution expenses. The costs have been determined according to the following methods:

- Finished Products and Products in Process: These inventories are stated at average production cost, according to the absorption costing method, including labor and the depreciation of the fixed assets, the amortization of the intangible assets and the indirect expenses of each period.

- Materials in Warehouse: These inventories are stated at acquisition cost and the Corporation determines a provision for obsolescence considering the permanence in stock of those slow moving materials in the warehouse.

- Materials in Transit: These inventories are stated at cost incurred until the period-end date. Any difference, due to the estimate of a lower net realizable value of the inventories, in relation to their accounting value, is adjusted with a charge to net income.

m) Dividends – The payment obligation of the net revenues presented in the financial statements, as determined in Article 6 of D.L. 1,350, is recognized based on the accrued payment obligation.

n) Personnel Benefits – Codelco recognizes provisions for personnel benefits when there is a current obligation as a result of the services provided.

The contract conditions stipulate, subject to the compliance of certain conditions, the payment of a termination indemnity when an employment contract ends. In general, this corresponds to the proportion of a month per year of service and considering the components of the final remunerations which are contractually defined as the basis for the indemnity. This benefit has been defined as a long-term benefit.

On the other hand, Codelco has agreed to post-retirement health plans with certain employees which are paid according to the fixed percentage over the monthly tax base of the employees covered by this agreement. This benefit has been defined as a long-term postretirement health benefit.

The severance payment obligation and the post-retirement health plans are calculated in accordance with valuations performed by an independent actuary, using the projected unit credit method, which are updated on a regular basis. The obligation recognized in the statement of financial position represents the net present value of the severance payment obligation and the health benefit. The actuarial gains and losses are recognized immediately in the statement of comprehensive income within the operating cost.

Management uses assumptions to determine the best estimate of these benefits. Such assumptions include an annual discount rate, the expected increases in the remunerations and future permanence, among other.

The Corporation in accordance with its operating optimization programs to reduce costs and increase labor productivity by incorporating new current technologies and/or practical management best practices has established employee retirement programs by means of related addenda to employees contracts or collective bargaining agreements with benefits that encourage employees to retire. Accordingly, the required provisions are established based on the accrued obligation at current value.

o) Provisions for Dismantling and Restoration Costs – An obligation arises when incurred in dismantling and restoration cost when an alteration is generated caused by a mining activity (in development or in production). The costs are estimated based on a formal closure plan and are subject to regular reviews. The costs arising from the obligation of dismantling the installation of a plant or other works for the preparation of the site, discounted at their net present value, are accrued and capitalized at the beginning of each project, as soon as the obligation to incur in such costs is originated.

These dismantling costs are stated in net income through the depreciation of the asset that gave rise to such cost and the use of the provision when the dismantling takes place. The subsequent changes in the estimates of the liabilities related to dismantling are added to or deducted from the costs of the related assets in the period in which the adjustment is made.

The restoration costs are accrued at their net present value against operating income and the use of the provision is made in the period in which the restoration works are performed. The changes in the measurement of the liability related to the location of the mining activity are recorded in the operating income.

The effects of the update of the liability, due to the discount rate and/or time, are recorded as a financial expense.

p) Leases – Leases are classified as financial leases when the lease transfers substantially all risks and rewards of ownership to the lessee. All other leases are classified as operating leases.

The lease payments under operating leases are recognized as expenses over the lease term. Assets acquired under financial leases are initially recognized as net income at the lower of the fair value and the present value of the minimum lease payments discounted at the implicit interest rate of the contract.

Interest is charged within financial expenses, at a constant interest rate, in the same depreciation period over the useful life the asset.

The service and supply contracts that meet the conditions established in IFRIC 4, Determining whether an Arrangement Contains a Lease are recorded as a financial or operating lease contract, as appropriate (IFRIC = International Financial Reporting Interpretations Committee).

q) Revenue Recognition – Revenues are recorded when the ownership rights and obligations have been substantially transferred to the purchaser, according to the shipment or dispatch of the products, in conformity with the agreed conditions and are subject to the variations related to the content and/or sales price at their liquidation date.

The sales contracts include a provisional price at the shipment date, whose final price is based on the price of the London Metal Exchange (“LME”). This final price will be fixed on the dates indicated in the contracts. The revenues at provisional prices are mark-to-market adjusted and are charge in net income.

The sales in the national market are recorded in conformity with the regulations that govern domestic sales as indicated in Articles 7, 8 and 9 of Law No. 16,624, modified by Article 15 of Decree Law No. 1,349 of 1976, on the determination of the sales price for the internal market.

As indicated in the note related to the hedging policies in the metal futures market, the Corporation performs operations in the futures market. The net results of these contracts are added to or discounted from the sales revenues.

r) Derivative Contracts – Codelco uses derivative financial instruments to reduce the risk of fluctuations of the sales prices of its products from exchange rates and interest rates.

The derivatives are initially recognized at fair value at the date on which the derivative is entered into and subsequently updated at fair value at each reporting date.

The effective part of the changes in fair value of the derivatives that are allocated as “effective cash flow hedgesâ€, is recognized directly in equity, net of taxes, in the item “Cash flow hedge reserves”, while the ineffective part is recorded in net income. The amount recognized in net equity is not transferred to the income statement account until the results of the hedged operations are recorded in the income statement or until the maturity date of such operations.

A hedge is considered highly effective when the changes in fair value or in the cash flows of the underlying attributable to the hedged risk, are offset with the changes in the fair value or in the cash flows of the hedge instruments, with effectiveness between a range of 80% – 125%. The corresponding unrealized profit or loss is recognized in comprehensive income for the period, only in those cases in which the contracts are liquidated or when they no longer comply with hedging characteristics.

The total fair value of the hedge derivatives is classified as a non-current asset or liability, if the remaining maturity of the hedged item is greater than 12 months, and as a current asset or liability, if the remaining maturity of the hedged item is lower than 12 months. All derivatives designated as hedge instruments are classified as current or non-current assets or liabilities, respectively, depending on the maturity date of the derivative.

The derivative contracts entered into by the Corporation are originated by the application of the risk hedge policies indicated below, and are recorded as indicated for each case:

• Hedging Policies for Exchange Rates and Interest Rates

The Corporation enters into exchange rate hedge transactions to cover exchange rate variations between the US dollar and the other currencies its transactions are made in. It has also contracted interest rate hedge transactions to cover fluctuations of interest rates for future obligations denominated in US dollars. According to the policies of the Board of Directors these operations are only performed when there is a balance (asset or liability) or an existing flow supporting it, and not for investment or speculative reasons.

The results of the exchange rate hedge operations are recorded at the maturity or liquidation date of such contracts.

The results of the hedging contracts for interest rates for future liabilities are amortized over the term of those liabilities.

• Hedging Policies in the Futures Metal Markets

In accordance with the policies approved by the Board of Directors the Corporation entered into contracts in order to hedge future metal prices, backed by physical production, in order to minimize the inherent risks in price fluctuations.

The hedging policies seek on the one hand to protect the expected cash flows from the sale of products by fixing the prices for a portion of future production, and on the other hand to adjust physical contracts to its commercial policy, when necessary.

When the sales agreements are fulfilled and the future contracts are settled, income from the sales and futures operations are offset.

The results of these hedging transactions are recorded at the settlement date of the hedging operations, as part of the sales revenue of the products. Hedging operations carried out by the Company are not of a speculative nature.

• Embedded Derivatives

The Corporation has established a procedure that allows evaluating the existence of embedded derivatives in financial and non-financial contracts. Where there is an embedded derivative, and if the host contract is not recorded at fair value, the procedure determines whether the characteristics and risks of the embedded derivative are not closely related to the host contract, in which case it requires a separate recording.

The procedure consists in an initial characterization of each contract that allows to distinguish those in which an embedded derivative could exist. In such case, such contract is submitted to a more in-depth analysis. If as a result of this evaluation it is determined that the contract has an embedded derivative that needs to be recorded separately, it is valued and the movements in its fair value are recorded in comprehensive income in the consolidated financial statements.

s) Financial Information per Segment – For the purposes of IFRS 8, Operating Segments it has been defined that the segments are determined according to the Operating Divisions, adding Yacimiento Gabriela Mistral operation, which make up Codelco. Income and expenses of headquarters are distributed in the defined segments.

t) Presentation of Financial Statements – For the purposes of IAS 1, Presentation of the Financial Statements, the Corporation establishes the presentation of its statement of financial position classified in “current and non-current†and of its statements of income in conformity with the “by function” method and its cash flow through the direct method.

u) Current and Non-Current Financial Assets – The Corporation determines the classification of its investments upon initial recognition and reviews these at each closing date. This classification depends on the purpose for which such investments were acquired.

In this section the following categories are observed:

• Financial Assets at Fair Value through Profit or Loss: This category includes those financial assets acquired for trading or sale in the short term. Their initial and subsequent recognition is performed at fair value, which is obtained as of the observable date in the market. The gains and losses from the variations in the fair value are included in the net income for the period.

• Loans Granted and Accounts Receivable These correspond to financial assets with fixed or determined payments, and which are not quoted in an active market. They arise when the Corporation provides – for valuable consideration – cash, goods or services directly to a debtor without the intention of negotiating the accounts receivable that is generated by the transaction. Its initial recognition is at fair value which includes the transaction costs that are directly attributed to the acquisition or issuance of it. Subsequent to the initial recognition these are stated at amortized cost, recognizing in the income statement the accrued interest according to the effective interest rate and the possible losses in the value of these assets.

A loss in value of the financial assets stated at amortized cost is caused when there is objective evidence that the Corporation will not be able to recover all the amounts in accordance with the original terms.

The amount of the loss in value is the difference between the carrying amount and the net present value of the future cash flows discounted at the effective interest rate and it is recognized as an expense in the income statement.

If in subsequent periods there is evidence of a recovery in the value of the financial asset stated at amortized cost, the recognized impairment loss will be reversed as long as it does not generate an amount in the financial asset ledgers that exceeds the one recorded prior to the loss. The accounting of the reversal is recognized in net income for the period.

Finally, an account receivable is not considered recoverable when there are situations such as the dissolution of the company, the lack of identifiable assets for its execution or a legal pronouncement.

• Available-for-Sale Financial Assets Financial assets available for sale are non-derivative financial assets designated specifically in this category, or not classified in any other category. They are included in non-current assets unless Management intends to dispose of the investment in the following 12 months after the date of the Statement of Financial Position.

v) Financial Liabilities – Financial liabilities are recognized initially at fair value, net of the incurred transaction costs. As the Corporation does not own financial liabilities held for trading, subsequent to their initial recognition, the financial liabilities are valued at amortized cost, using the method of the effective interest rate, recognizing the interest expenses based on the effective profitability.

The effective interest method is a method of calculating the amortized cost of a financial liability and of allocating the interest expense over the relevant period. The effective interest rate is the rate that exactly discounts estimated future cash payments through the expected life of the financial liability, or when appropriate, a shorter period when the associated liability has a prepayment option that is considered to be exercised.

The trade accounts payable and other payables are financial liabilities that do not explicitly accrue interest and are recorded at their nominal value. The financial liabilities are derecognized when the liabilities are paid or expire.

w) Provisions for Doubtful Debts – The Corporation maintains an provisions for doubtful debts, based on the experience and analysis of Management regarding the portfolio of trade debtors and the aging of the entries.

x) Intangible Assets – Intangible assets are recorded at the value of actual disbursements. Amortization, were appropriate, is recognized in accordance with IAS 38.

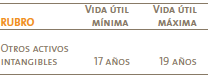

Intangible assets are amortized using the straight-line method over their economic useful life as follows:

The internally generated computer systems using the Company’s own human resources and materials are charged to net income in the period in which they are incurred.

y) Statement of Cash Flows – For the purposes of preparing the statement of cash flows, the Corporation has defined the following: Cash and cash equivalents include cash on hand, time deposits in credit institutions and other short-term investments of great liquidity with an original maturity of three months from their acquisition date. In the statement of financial position the bank overdrafts are classified as external resources in current liabilities.

Operating Activities: These are the activities that constitute the main source of ordinary income of the Corporation, as well as other activities that cannot be classified as investment or financing activities.

Investing Activities: These correspond to activities of acquisition, sale or disposal through other methods of long-term assets and other investments not included in cash and cash equivalents.

Financing Activities: These are activities that cause changes in the size and composition of the net equity and of the financial liabilities.

z) Law No. 13,196 – The amount for this concept is presented in the statement of income in the item other expenses, by function.

aa) Cost of Sales – Cost of sales is determined according t the absorption cost method, including the direct and indirect cost, depreciation, amortization and any other expenses associated with the production process.

ab) Environment – The Corporation adheres to the principles of sustainable development, which combines the economic development while safekeeping the environment and the health and safety of its collaborators. The Corporation recognizes that these principles are key for the wellbeing of its collaborators, the care of its environment and to succeed in its operations.

ac) Classification of Current and Non-Current Balances – In the consolidated statement of financial position, the balances are classified according to their maturities, that is, as current those with a maturity equal or inferior to twelve months and as noncurrent those with a greater maturity.

Where there are obligations whose maturity is less than twelve months, but whose long-term refinancing is insured upon decision of the Company, through credit agreements available unconditionally with long-term maturity, these could be classified as noncurrent liabilities.

New Accounting Pronouncements

As of the issuance date of these consolidated financial statements, the following IFRS and IFRIC interpretations have been issued by the IASB, but it was not obligatory to apply them1:

The Management early applied the Amendment to IFRS 7, Financial Instruments: Disclosures – Transfers of Financial Assets in these financial statements.

Notwithstanding the above, the Management believes that these standards, amendments and interpretations, will be adopted in the consolidated financial statements of the Corporation in the respective years, and that their adoption will not have a significant impact in the financial statements of Codelco in the year of their initial application.