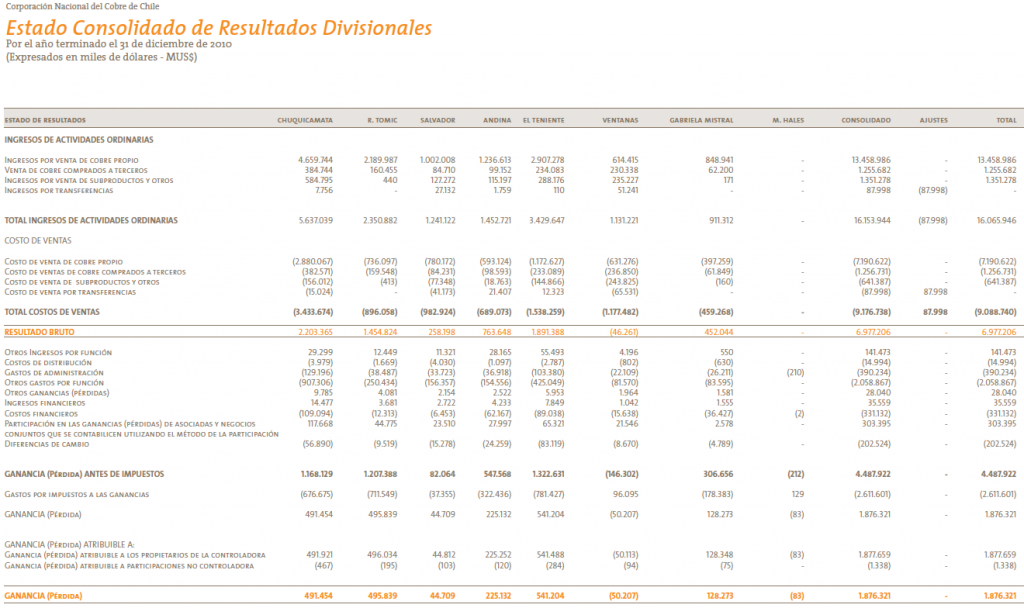

Consolodated Divisional Statementes of income

(Haga click en la imagen para ver la tabla completa)

Basis of Preparationof The Divisional Statements of Income

On November 19, 2010, it was authorized the operation of the Mina Ministro Hales, which will be managed by the new Division Mina Ministro Hales, whose estimated date for commencing operations will be by the end of 2013.

The divisional statements of income are prepared in compliance with the Corporation’s by-laws in conformity with International Financial Reporting Standards and the following internal bases:

Note 1.

Interdivisional transfers

Interdivisional transfers of products and services were carried out and recorded at prices equivalent to those that prevail in market conditions. Therefore, these divisional statements of income include the following concepts:

- Revenues from sales to third parties of products received from other Divisions and the divisional income from transfers to other Divisions are presented in separate lines.

- Consistently with the above, costs of products received from other Divisions and sold to third parties and costs allocated to divisional income from transfers to other Divisions are also presented in separate lines.

Note 2.

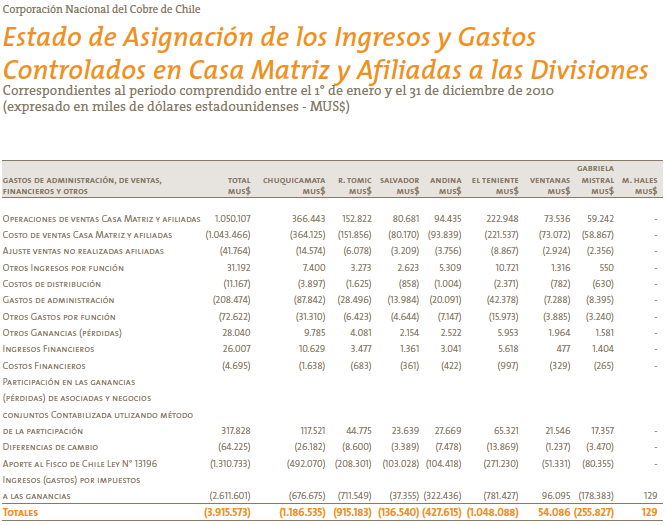

Allocation of Corporate income and expenses

Income and expenses controlled by Corporation’s Head Office and Subsidiaries are added to direct income and expenses of the Divisions, in accordance with current bases established for the year, as established in the Statement of Allocation of Income and Expenses Controlled by Head Office and Subsidiaries to the Divisions.

Other operating expenses include the expense derived from Law N°13,196, which levies the Corporation by 10% over the foreign currency received from sales of its copper production abroad, including by-products and their allocation by Division is as follows:

Criteria Applied to the Allocation of Income and Expenses Controlled by the Head Office and Subsidiaries to its Divisions

On November 19, 2010, it was authorized the operation of the Mina Ministro Hales, which will be managed by the new Division Mina Ministro Hales, whose estimated date for commencing operations will be by the end of year 2013.

Income and expenses controlled by the Head Office and Subsidiaries are allocated to its Divisions in accordance with the criteria set forth for each item of the income statement accounts, as follows:

1. Revenue and cost of sales of the commercial activities of the Head Office and Subsidiaries and adjustment for unrealized sales in Subsidiaries

The allocation to divisions is made in proportion to the revenue by each Division.

2. Other income, by function

- Other income, by function, associated with and identified in each particular Division are directly allocated.

- Recognition of subsidiaries’ realized profits and other income by function, are allocated in proportion to the revenue by each Division.

- The remaining other income is allocated in proportion to the aggregate of balances under “other income” and under “financial income” by the respective Divisions.

3. Distribution costs

- Costs associated with and identified in each Division are directly allocated.

- Distribution costs of subsidiaries are allocated in proportion to the revenue by each Division.

4. Administrative expenses

- Administrative expenses recorded in cost centers identified in each Division are directly allocated.

- Administrative expenses recorded in cost centers associated with the sales function and administrative expenses of subsidiaries are allocated in proportion to the revenue by each Division.

- Administrative expenses recorded in cost centers associated with the supply function are allocated in relation to material account balances in each Division warehouses.

- The remaining expenses recorded in cost centers are allocated in relation to operating cash outflows in the respective Divisions.

5. Other expenses, by function

- Other costs associated with and identified in each particular Division are directly allocated.

- Pre-investment expenses and other expenses by function are allocated in proportion to the revenue by each Division.

6. Other gains

- Other gains associated with and identified in each particular Division are directly allocated.

- Other gains from subsidiaries are allocated in proportion to the revenue by each Division.

7. Financial income

- Financial income associated with and identified in each particular Division are directly allocated.

- Interest income from subsidiaries is allocated in proportion to the revenue of each Division.

- The remaining financial income is allocated in relation to operating cash outflows of each Division.

8. Financial costs

- The financial costs associated with and identified in each particular Division are allocated directly.

- The financial costs of subsidiaries are allocated in proportion to the revenue of each Division.

9. Share of profit (loss) of associates and joint venture accounted for using equity method

- Share of profits or losses of associates and joint ventures identified in each particular Division are directly allocated.

10. Exchange differences

- Exchange differences are identified in each particular Division are directly allocated.

- Exchange differences of subsidiaries are allocated in proportion to revenue of each Division.

- The remaining exchange differences are allocated in relation to operating cash outflows of each Division.

11. Contribution to the State of Chile Law No. 13,196

- This contribution is allocated and recorded in relation to the amounts billed and accounted for by exports of copper and by-products by each division affected to the contribution.

12. Income taxes

- Income and D.L. N°2,398 tax and the specific tax on mining activities, are allocated in accordance with the income before tax by each Division, considering for these purposes the effects of the Head Office and Subsidiaries’ allocation of income and expenses criteria mentioned above.

- Specific tax on mining activities and other tax expenses are allocated based on the income and D.L. 2,398 tax attributable to each Division.