Economic Financial Results

Pre-tax Profits and Copper Prices

Codelco’s pre-tax profits totalled US$ 5.799 billion in 2010. This implies an increase of almost 47% compared to the US$ 3.948 billion in 2009.

Pre-tax profits correspond to earnings before income tax and Tax Reserve Law No 13,196 that levies a 10% tax on foreign currency sales of copper and by-products.

The average copper price for the year at the London Metals Exchange was US$ 342.0 per pound, higher than in 2009, when it was US$234.2 per pound. The average molybdenum price for the year was up from US$ 24.5/kg in 2009 to US$ 33.7/kg in 2009, based on Metals Week prices.

The price behaviour of the main metals sold by the Company explains, to a large extent, the improved financial results delivered in 2010 over the prior year.

Therefore, operating income from its own copper mining rose to US$ 13.459 billion in 2010, higher than the US$ 9.675 billion for the prior year.

The EBITDA, calculated as earnings for the period plus depreciation and amortization, interest and taxes – including Law 13,196 – totalled US$ 7.435 billion, higher than the US$ 5.349 billion in 2009.

Comparable net profit in 2010, .i.e., applying the same tax as private companies, was US$ 4.61 billion. With this figure, Codelco confirms it is first in the earnings ranking for firms that operate in Chile.

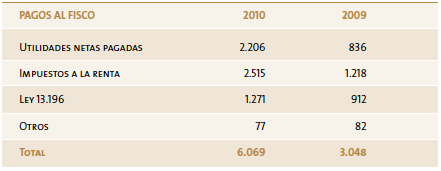

Contribution to the Treasury

In 2010, Codelco contributed US$ 6.069 billion to the Chilean Treasury. The following table shows contributions to the Treasury compared to the prior year.

Production

Codelco’s copper production from its own deposits stood at 1,689,067 tonnes of fine copper, very similar to the 1,701,998 tonnes of fine copper in 2009.

The 2010 production level was obtained thanks to a mining plan focused on offsetting the lower level of treatment, by improving the ore grade. As a result of this plan, the average ore grade was 0.85% in 2010, up from 0.83% for the prior year.

Less ore treatment was due to the startup of projects: Andina Phase I, Pilar Norte at El Teniente and Gabriela Mistral Mine Phase II; which affected the normal operation of these deposits, reducing the actual operating days.

Codelco’s total copper output was 1,760,198 tonnes. This includes Codelco’s output from the 49% stake it holds in Minera El Abra, that was 71,131 tonnes of fine copper.

In by-products, molybdenum output was 21,700 tonnes; while sulphuric acid production totalled 3.4 million tonnes, of which 60% went to sales and the rest was used in leaching operations. As for precious metals, gold and silver content in anode bars was 3.5 tonnes and 394 tonnes, respectively.

Output levels for both copper and byproducts were in line with Codelco’s business plan.

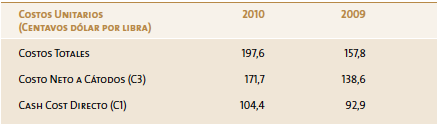

Costs

Total costs and expenses, including non-operating expenses, averaged US$197.6 per pound of copper produced, up US$39.8 per pound from 2009. Therefore, and as the rest of the mining industry that operates in Chile, Codelco’s costs were adversely affected by a stronger Chilean peso and its impact on expenses in local currency as they are stated in US dollars.

The increased price of practically all inputs had a similar impact since they strongly affect the cost structure. Additionally, Codelco’s total costs and expenses were affected by special events, many of non-recurring nature. Such as expenses related to the extraordinary early retirement plan, implemented during the third quarter – this meant a charge to results of approximately US$ 300 million – and derivatives from an important number of collective bargaining agreements, which had to be undertaken during the period, totalling US$ 208 million. A third factor that had an important impact on total costs and expenses was the effect of adopting IFRS in the preparation of the Company’s financial statements and which resulted in a significant increase in depreciation expense.

Net cathode costs (C3) include net byproduct credits and treatment and refining costs (TC-RC) to state in cathodes the types of lower-added value copper, were US$171.7 compared to US$138.6 in 2009.

Cash costs (C1) were US$104.4 per pound, up US$11.5 per pound from 2009. C1 cost is the type of cost that the mining industry uses to compare efficiency rates between different operations and companies. C1 costs are directly incurred in copper production and exclude non-operating expenses, such as depreciation and amortisation. These costs include cathode production TC-RC, net of by-product credits and by-product sales revenue (mainly molybdenum and sulphuric acid, in Codelco’s case). The increase in C1 costs was primarily due to the abovementioned external factors.

Risk factors

Copper Prices

Copper prices significantly affect Codelco’s financial performance. The Company’s strategy to protect itself from copper price fluctuations is to become one of the most cost-efficient producers in the mining industry.

Derivative operations do not involve speculative operations.

Currency Exchange and Interest Rates

The Company has policies to cover currency exchange rates and interest rates. Coverage for exchange rates includes exchange insurance for future fluctuations in UF (inflation indexed peso)/US dollar; while interest rate hedging involves contracts to set rates for future obligations.

These actions do not include speculative operations.

Insurance

Codelco has all its assets and potential business interruption permanently insured; the insurance coverage is as follows:

Insured assets All facilities used for its main business activity in Chilean territory.

Type of coverage Comprehensive and property insurance, combined with business interruption and a maximum loss of US$ 850 million.

Claims currently in process of adjustment:

Damage to SAG 2 Mill at El Teniente Mill The damage event, on 30 August 2008, caused a 16-day standstill. When it was finally repaired, in June 2009, there was another 44-day standstill. The final claim was submitted to the adjuster who is in the process of preparing the final report.

Earthquake Damage to Andina and El Teniente

The earthquake on 27 February 2010 caused some damage to the Andina and El Teniente Division facilities.

In both cases, no compensation for damages or losses is expected.

Funding

Codelco regularly has access to domestic and international capital markets to help fund its investments. This has enabled it to develop an extensive and geographically diversified base of financial institutions that invest in the debt instruments issued by the Company.

Hence, the Company has had access to American, Asian and European capital markets, through bond sales and syndicated and bilateral loans.

In 2010, Codelco carried out funding operations totalling US$ 1.8 billion to finance part of its investments implemented during the year and to refinance part of its existing debt. These operations consisted in issuing a US$ 1 billion bond and negotiating 5-year bilateral loans for US$ 800 million with bullet maturity.

Codelco is analysed and its debt assessed by four credit rating agencies: Fitch Ratings, Feller-Rate, Standard & Poor’s and Moody’s. In 2010, Codelco retained its investment-grade credit rating for its foreign debt: A1 by Moody’s; and A by Standard & Poor’s. As for local debt, Codelco has AAA rating, both by Fitch Ratings and Feller-Rate.

The Company is registered since 2002 with the Superintendency of Securities and Insurance (SVS) in Chile.

Bonds issued on International Market

In October, Codelco sold US$ 1 billion in 10-year bonds on the international market, to partially finance its investment plan and pay its debt maturing during the year. The conditions obtained, total rate of 3.96% and a 3.75% annual coupon; are the lowest rate ever for a Latin American corporate bond.

The fund administrators, insurance companies and pension funds represented 91% of the demand; while banks and hedge funds contributed 9%. The geographic distribution was: 80% in the United States; 18% in Asia and Europe, and 2% in Latin America. The transaction was arranged by HSBC and Deutsche Bank.